November 18, 2016 – By Hazel Jackson

Herve Tessler Insider Sell

Herve Tessler Insider Sell

Company insider, Herve Tessler, Senior Vice President of Xerox Corp sold a total of 14,000 shares of the firm, which is calculated based on a stock price of $9.5 for each one share. A filing documented published 17-11-2016 with the Security Exchange Commission, made public here, shows full details for the transaction. This sell decreased his ownership of Xerox Corp to 0.01% total market capitalization or 96,319 shares.

Xerox Corp (NYSE:XRX) Ratings Coverage

Out of 10 analysts covering Xerox Corporation (NYSE:XRX), 3 rate it a “Buy”, 3 “Sell”, while 4 “Hold”. This means 30% are positive. $15 is the highest target while $9 is the lowest. The $11.50 average target is 20.04% above today’s ($9.58) stock price. Xerox Corporation has been the topic of 16 analyst reports since July 28, 2015 according to StockzIntelligence Inc. The stock of Xerox Corp (NYSE:XRX) has “Overweight” rating given on Saturday, August 29 by Piper Jaffray. As per Wednesday, October 14, the company rating was initiated by Barclays Capital. The firm has “Sell” rating given on Wednesday, September 2 by Zacks. The rating was upgraded by Zacks to “Sell” on Wednesday, August 12. As per Tuesday, December 1, the company rating was initiated by Goldman Sachs. The stock of Xerox Corp (NYSE:XRX) has “Underweight” rating given on Monday, November 7 by Morgan Stanley. The stock of Xerox Corp (NYSE:XRX) earned “Neutral” rating by Credit Suisse on Tuesday, April 26. The rating was maintained by JP Morgan with “Neutral” on Tuesday, April 26. TheStreet upgraded the stock to “Buy” rating in Monday, August 17 report. Brean Capital downgraded Xerox Corp (NYSE:XRX) on Tuesday, April 26 to “Hold” rating.

Insitutional Activity: The institutional sentiment increased to 1.02 in 2016 Q2. Its up 0.04, from 0.98 in 2016Q1. The ratio is positive, as 38 funds sold all Xerox Corp shares owned while 169 reduced positions. 52 funds bought stakes while 160 increased positions. They now own 834.51 million shares or 1.20% less from 844.68 million shares in 2016Q1.

Icahn Carl C accumulated 4.64% or 99.03M shares. Sumitomo Mitsui Asset Management holds 0.02% of its portfolio in Xerox Corp (NYSE:XRX) for 69,283 shares. Pictet Asset Mgmt Ltd accumulated 0.02% or 497,592 shares. Creative Planning owns 19,832 shares or 0% of their US portfolio. Burney last reported 49,639 shares in the company. Cadence Capital Ltd Liability Corporation accumulated 0.22% or 303,254 shares. Tensile Cap Ltd accumulated 964,145 shares or 2.22% of the stock. Schroder Gru has 1.48M shares for 0.03% of their US portfolio. Wfg Advisors L P reported 115 shares or 0% of all its holdings. Profund Advsr Limited Liability last reported 0.01% of its portfolio in the stock. The Delaware-based Reliance Trust Company Of Delaware has invested 0.05% in Xerox Corp (NYSE:XRX). Amp Invsts Limited has 1.16M shares for 0.07% of their US portfolio. Amer Century reported 681,759 shares or 0.01% of all its holdings. Wealthfront Incorporated last reported 0% of its portfolio in the stock. First Manhattan last reported 1,554 shares in the company.

Insider Transactions: Since July 1, 2016, the stock had 0 insider buys, and 6 sales for $1.38 million net activity. On Wednesday, November 9 the insider Mancini Joseph H. sold $24,127. On Friday, July 1 the insider FIRESTONE JAMES A sold $467,895. Tessler Herve sold $128,573 worth of stock or 13,000 shares. On Thursday, November 3 BURNS URSULA M sold $711,491 worth of the stock or 74,815 shares.

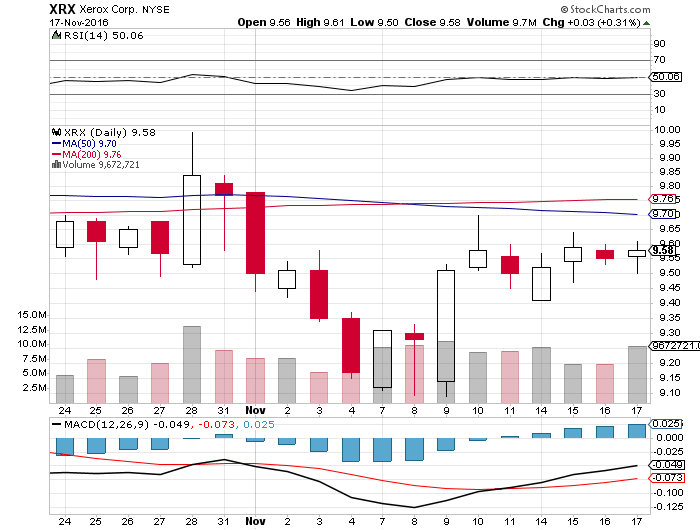

The stock increased 0.31% or $0.03 during the last trading session, hitting $9.58. About 9.67 million shares traded hands or 36.39% up from the average. Xerox Corp (NYSE:XRX) has declined 14.66% since April 15, 2016 and is downtrending. It has underperformed by 19.28% the S&P500.

Xerox Corporation is engaged in imaging, business process, analytics, automation and user-centric insights. The company has a market cap of $9.74 billion. The Company’s divisions include Services, Document Technology and Other. It has a 15.81 P/E ratio. The Company’s Services segment comprises two types of service offerings: Business Process Outsourcing and Document Outsourcing (DO).

According to Zacks Investment Research, “Xerox is the world’s leading enterprise for business process and document management. Its technology, expertise and services enable workplaces – from small businesses to large global enterprises – to simplify the way work gets done so they operate more effectively and focus more on what matters most: their real business. Headquartered in Norwalk, Conn., Xerox offers business process outsourcing and IT outsourcing services, including data processing, healthcare solutions, HR benefits management, finance support, transportation solutions, and customer relationship management services for commercial and government organizations worldwide. The company also provides extensive leading-edge document technology, services, software and genuine Xerox supplies for graphic communication and office printing environments of any size.”

More notable recent Xerox Corp (NYSE:XRX) news were published by: Businesswire.com which released: “XRX REMINDER: Rosen Law Firm Reminds Xerox Corporation Investors of Important ..” on November 11, 2016, also Streetinsider.com with their article: “Xerox Corp. (XRX) Reports In-Line Q3 EPS; Guides Q4, FY16 Inline with Views ..” published on October 28, 2016, Streetinsider.com published: “Xerox Corp. (XRX) Announces Conduent’s Form 10 is Now Effective” on November 10, 2016. More interesting news about Xerox Corp (NYSE:XRX) were released by: Reuters.comand their article: “BRIEF-Xerox Corp says Conduent has no immediate plans to pay common divide..” published on November 07, 2016 as well as Democratandchronicle.com‘s news article titled: “Alleged Xerox robber-killer to be in court” with publication date: November 06, 2016.