FORBES

Carl Icahn renforce encore sa participation dans Xerox

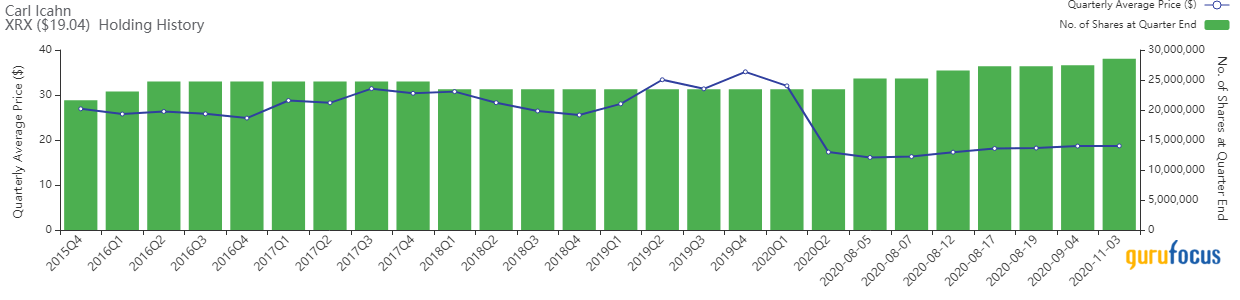

Poursuivant sa séquence d’augmentation de la participation de Xerox Holding Corp. (NYSE: XRX) au cours des derniers mois, Carl Icahn (Trades, Portfolio) a révélé qu’il avait augmenté la position de 3,86% plus tôt cette semaine.

La firme du gourou basée à New York, Icahn Capital Management, est connue pour prendre des positions militantes dans des entreprises sous-évaluées et en difficulté et travailler avec la direction afin d’améliorer la rentabilité et de dégager de la valeur pour les actionnaires.

Selon GuruFocus Real-Time Picks, une fonctionnalité Premium, Icahn a récupéré 1,06 million d’actions supplémentaires du fabricant d’imprimantes basé à Norwalk, dans le Connecticut, le 3 novembre, impactant le portefeuille d’actions de 0,10%. L’action se négociait à un prix moyen de 18,69 $ par action le jour de la transaction.

Il détient désormais 28,53 millions d’actions, qui représentent 2,7% du total des actifs gérés et représentent près de 14% du capital de la société. C’était sa 10e plus grande participation à la fin du deuxième trimestre.

Carl Icahn Further Tones Up Stake In Xerox

Continuing his streak of increasing the Xerox Holding Corp. (NYSE:XRX) stake over the past several months, Carl Icahn (Trades, Portfolio) disclosed he boosted the position another 3.86% earlier this week.

The guru’s New York-based firm, Icahn Capital Management, is known for taking activist positions in undervalued, struggling companies and working with management in order to improve profitability as well as unlock value for shareholders.

According to GuruFocus Real-Time Picks, a Premium feature, Icahn picked up another 1.06 million shares of the Norwalk, Connecticut-based printer manufacturer on Nov. 3, impacting the equity portfolio by 0.10%. The stock traded for an average price of $18.69 per share on the day of the transaction.

He now holds 28.53 million shares, which account for 2.7% of the total assets managed and represent a nearly 14% stake in the company. It was his 10th-largest holding at the end of the second quarter.

GuruFocus estimates the firm has lost 22.42% on the investment since establishing it in the fourth quarter of 2015.