Marlene Satter | décembre 19, 2019 at 08:33 AM

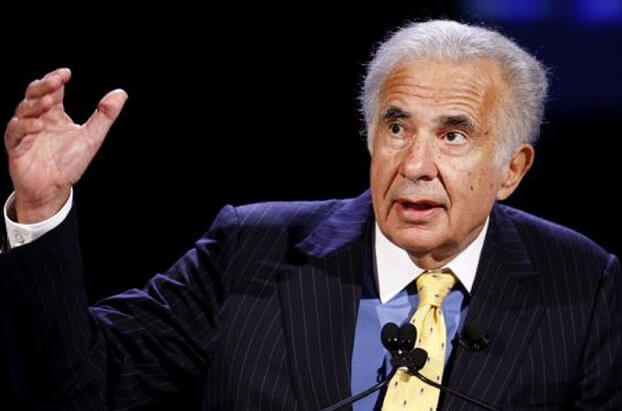

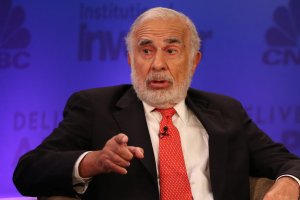

Icahn est le plus grand actionnaire de Xerox.

L’investisseur activiste Carl Icahn est la cible d’un procès par un actionnaire de Xerox Holdings Corp, après que ce dernier a allégué qu’Icahn avait acheté des actions de HP Inc. tout en sachant que Xerox prévoyait d’offrir une prime pour acheter des actions HP.Selon un rapport de Reuters, la Miami Firefighters Relief and Pension Fund a déposé une plainte contre Icahn et un véhicule d’investissement qu’il contrôle.Icahn est le plus grand actionnaire de Xerox, détenant 11% des actions et, au 30 septembre, détenait également 4,2% de HP en tant que cinquième plus grand actionnaire.

En novembre, HP a rejeté une offre d’achat non sollicitée de Xerox, selon Bloomberg. Cependant, Icahn, sachant que Xerox envisageait la décision de HP, a exhorté HP à accepter l’offre de Xerox.Un rapport du WHEC indique qu’Icahn a acheté le stock de HP – d’une valeur de 1,2 milliard de dollars – en gardant à l’esprit la prise de contrôle proposée.Selon Bloomberg, dans la divulgation d’Icahn en août, aucun actionnariat de HP au 30 juin n’était répertorié. Il indique également que la poursuite allègue que «Icahn, Icahn Capital LP et High River Limited Partnership ont violé leurs obligations fiduciaires envers Xerox en achetant des actions HP en sachant que« Xerox envisageait de faire une offre d’achat de HP, avait déjà approché HP à propos de une éventuelle fusion ou acquisition par Xerox, ou des avantages évidents de l’acquisition potentielle de HP par Xerox. »»Axios rapporte que le rejet par HP de l’offre de novembre de Xerox a été unanime, car son conseil d’administration estimait que « l’offre sous-évaluait HP et comportait trop d’incertitude et de dette ».

Icahn is the largest shareholder in Xerox.

Activist investor Carl Icahn is the target of a lawsuit by a shareholder of Xerox Holdings Corp, after the latter alleged that Icahn bought stock in HP Inc. while knowing that Xerox planned to offer a premium to buy HP stock.

According to a Reuters report, the Miami Firefighters Relief and Pension Fund filed the lawsuit against Icahn and an investment vehicle he controls.

Icahn is the largest shareholder in Xerox, owning 11 percent of the stock, and as of September 30 also owned 4.2 percent of HP as its fifth largest shareholder.

In November, HP rejected an unsolicited takeover offer from Xerox, according to Bloomberg. However, Icahn, knowing that Xerox was considering the HP move, urged HP to accept Xerox’s offer.

A WHEC report says that Icahn bought the HP stock—$1.2 billion worth—with knowledge of the proposed takeover in mind.

According to Bloomberg, in Icahn’s August disclosure, no HP stock ownership as of June 30 was listed. It also says that the suit alleges that “Icahn, Icahn Capital LP and High River Limited Partnership breached their fiduciary duties to Xerox by buying HP stock with the knowledge that ‘Xerox was either considering making an offer to purchase HP, had already approached HP about a possible merger into or acquisition by Xerox, or of the obvious merits of Xerox’s potential acquisition of HP.’”

Axios reports that HP’s rejection of Xerox’s November offer was unanimous, because its board believed “the bid undervalued HP and included too much uncertainty and debt.”